At least 100,000 more borrowers joined Safaricom’s overdraft facility, Fuliza in the face of a tough economy to meet basic needs.

According to the telco’s financial results for the first six months to September 30, Fuliza subscribers rose to 7.5 million from 7.4 million a year ago.

Even so, the average loan size taken dropped by Sh60 in value to Sh260 from Sh320.90, impacting the product’s contribution to the firm’s overall revenue.

The total revenue contributed by the product to the telco’s balance sheet dropped by 40.3 per cent in the six months under review to Sh2 billion compared to Sh3.4 billion in the corresponding half last year.

Despite the financial strain, borrowers improved on loan repayment in the review period, with the value of repayment hitting Sh400.8 billion compared to Sh304.6 billion.

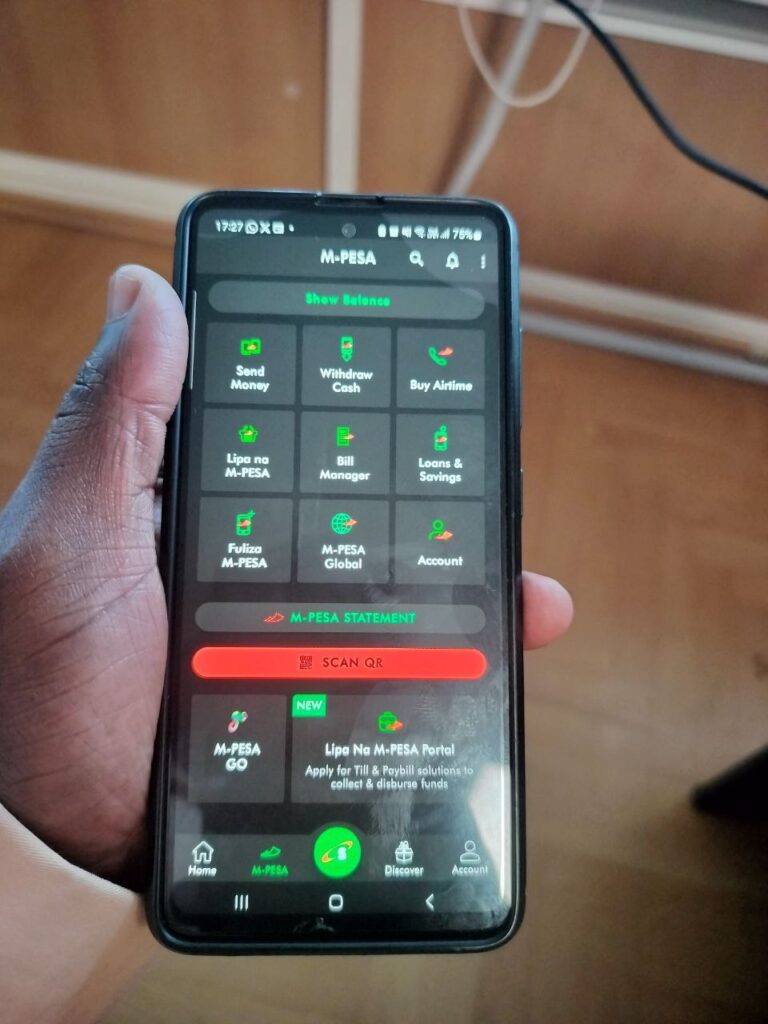

Fuliza has been charging a daily fee of Sh6 from Sh10 in October last year for credit worth Sh500 to Sh1,000.

Furthermore, those borrowing loans of between Sh101-499 pay a Sh3 daily while those who seek to draw Sh2500-70,000 are paying an average of Sh25.

“Even though the revenue has declined, the actual disbursement has grown and it was intended to be that way that we want to make it more affordable and we want to expand the base,” Safaricom CEO Peter Ndegwa said.

Read Also: Airtel Money Revises Mobile Money Tariff Guide

The increased subscription to the credit facility by families confirms the latest report by the Financial Sector Deepening {FSD} which indicates that more families are using savings and loans to cope with the high cost of living.

According to the report, the uptake of credit rose from 50.4 per cent to 60.8 per cent in the period under review.

Last year, a report by the National Treasury showed that more than half of families in Kenya cannot afford basic needs.