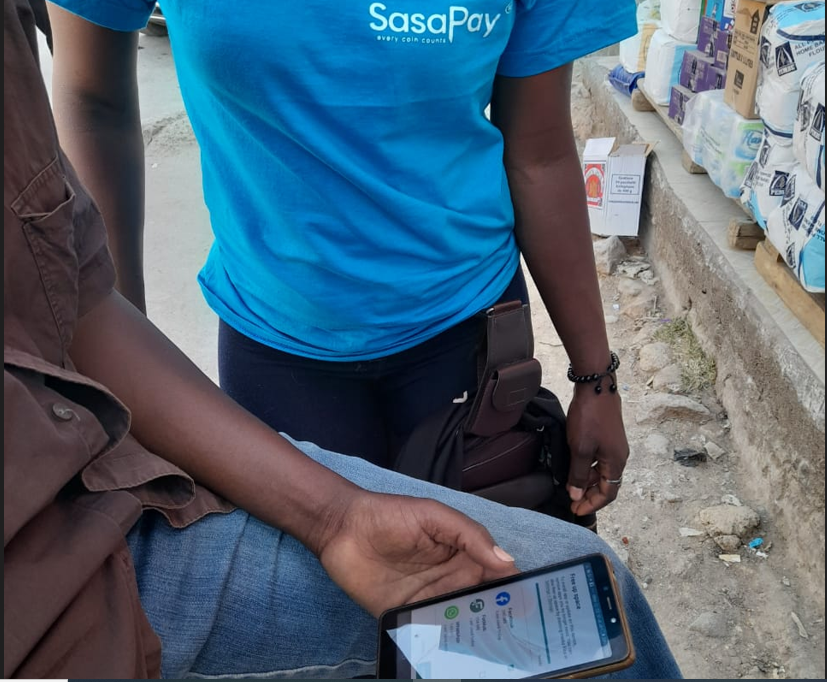

Sasapay, CBK regulated Fintech is flontearing as the emerging reliable superhero of online transactions, here to save the day! Their new Escrow service is like payment superpower.

A protective bubble that keeps your money safe and sound until both parties in a transaction are happy.

“SasaPay provides you with an Escrow e-wallet account which receives and disburses money for the primary transacting parties, with the disbursement dependent on conditions agreed to by the transacting parties.”

The escrow services are also available through sasapay API’s giving the innovators and e-commerce providers access to uterize it on their solutions.

READ ALSO: KCB Signs African Cross-Border Payment deal to Support Customers

” Our dream is to empower our customers to build trust within payment processes. This will foster growth and innovative solutions built through SasaPay platform.

Its exciting for us as we witness all payments solutions converging at sasapay platform”

SasaPay Partnership

In late last year the Electronic payment company Viewtech Limited signed a partnership with OMA Service to allow customers using electronic buses to pay fares digitally.

Through the mobile money platform, travelers will are now using the platform to pay for their trips.

The collaboration was aimed at promoting the use of electric buses provided by BasiGo while simplifying passenger payment processes.

The move to go cashless in the matatu industry has been a debate in the country in recent past with the Matatu Owners Association calling for the introduction of a cashless system in Nairobi city transport.

Passengers can top up their accounts and pay for their tickets directly from the app or through a USSD code, eliminating the need for physical cash or physical tickets.