Unlimit, the leading global fintech and payment solutions company, is thrilled to announce its entry into the Kenyan market and the receival of the Central Bank of Kenya licence, marking a significant milestone in its ongoing expansion throughout Africa.

This strategic move follows Unlimit’s recent acquisition of the Central Bank of Nigeria licence, solidifying the company’s official recognition as a reputable provider of payment solutions within the region.

As part of its strategic expansion,Unlimit is committed to delivering an unparalleled payment experience by integrating internationally acclaimed payment best practices, industry-leading security protocols, comprehensive merchant analytics, and a customer-friendly interface. By offering diverse payment solutions, Unlimint will cater to the preferences and support the unique requirements of local enterprises in Kenya.

This milestone demonstrates Unlimit’s dedication to advancing the payment landscape in Africa and empowering businesses with cutting-edge payment solutions.

Trevor Goott, Director for Africa and India at Unlimit, expressed immense enthusiasm about the company’s African expansion and its entry into the Kenyan market.

“It gives me great pleasure to bring on board Kenya as our second African country, following the recent announcement of the awarding of our Nigerian licence,” said Goott.

On The Global Map

“We are also pleased to add Kenya to our global portfolio for our foreign merchants seeking access to the Kenyan market. The high demand from our international merchants to establish local operations in Kenya has further motivated us to enter the market. Also, given its strategic location in East Africa, Kenya serves as an ideal hub for the expansion of our operations in the region.”

Commenting on the expansion, Unlimit’s CEO, Kirill Evstratov, said: “We have ambitious plans for Kenya and East Africa, and are looking forward to supporting local businesses on their expansion goals.

For 14 years we have successfully been aiding companies worldwide enter new markets and go beyond borders, strengthening their business outreach and expanding their customer base. Now, we are bringing those years of expertise to Africa.

READ ALSO: MFS Africa Wins Fintech of the Year award in Egypt

Our unwavering ambition is to establish ourselves as the benchmark in the payments processing industry, setting the standard for excellence and innovation, and allow companies around the globe to go borderless with their payments. “

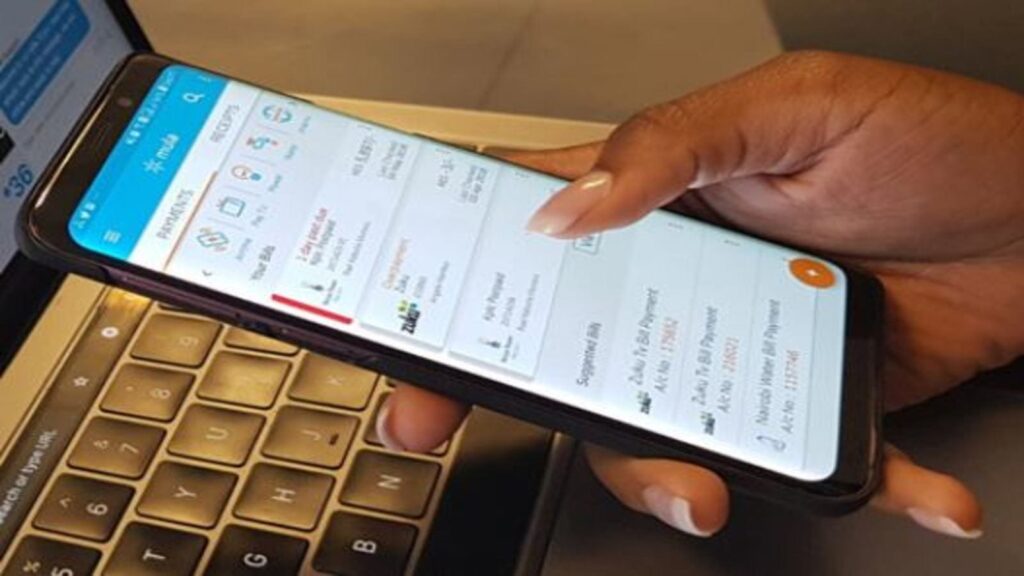

Over the last 15 years, Kenya has emerged as a leading force in the African payment ecosystem, gaining global recognition for its ground-breaking mobile money revolution. This

innovation has not only propelled Kenya’s economy forward but has also facilitated business expansion for numerous companies. Leveraging mobile payment technology, Kenya has created a robust payment infrastructure that presents promising opportunities for both domestic and foreign enterprises seeking to establish a presence in the country.

By expanding its operations to Kenya, Unlimit strengthens its position in the continent’s payment landscape as part of its mission to lead Africa’s payment evolution in the coming years.