Blockchain Association of Kenya (BAK) is now pushing for new reforms that will govern how new players join Kenyan market.

The digital asset industry lobby group, is among others, proposing for the formation of a new regulatory sandbox that will test and regulate players in the industry before licensing.

In the proposed Virtual Asset Service Provider (VASP) bill, submitted to the National Assembly, BAK is proposing that businesses dealing in digital assets in the country be allowed to operate as commercial entities.

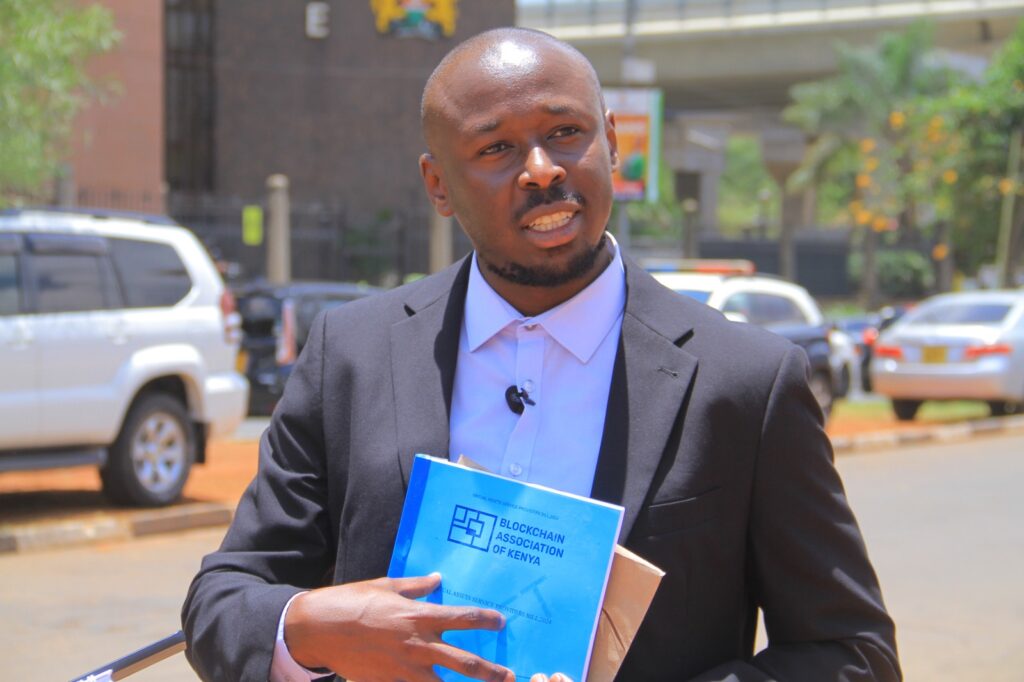

Chair of the Blockchain Association of Kenya, Michael Kimani says that the bill contains a licensing framework on how crypto firms will register in Kenya, and sandbox that will enable business come through before approval.

“Virtual currency businesses have been struggling to get into the CMA sand box because of the lack of a framework. What this draft bill is proposing is a joint regulatory sandbox that will involve CBK, CMA and all other regulators where they can all take part jointly in approving some of these business coming into the sandbox,” said Kimani

Read Also: Blockchain Association of Kenya Invites feedback on draft Virtual Assets Service Provider Bill

The BAK was tasked to draft a framework to govern the cryptocurrency industry because the lack of a framework has led to the mushrooming of dubious cryptocurrency scams that have defrauded Kenyans of millions.

The VASP Bill was set to be handed over to the National Assembly Committee on Finance on February 14th, 2023.

However, due to growing interest from new stakeholders such as government agencies and other stakeholders affected by elements of the bill, the association in consultation with its members decided to extend the feedback period.

The Bill, he said, addresses the industry, consumer and regulator concerns by proposing a licensing framework, consumer protection framework, Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) and a regulatory sandbox.

Regulation of digital assets has been a contentious topic in the past few years with developed countries such as the United States, Hong Kong and Singapore setting the tone for reining in an industry perceived as wild west by mainstream financial regulators.

In Africa, countries like Nigeria and South Africa have already put in place regulations to manage the industry which is seen as enabling capital flight and providing avenues for criminal activity such as money laundering.

The draft VASP Bill will put Kenya on the map as a digital asset hub. If passed, the bill will see an inflow of tax revenues into the coffers of Kenya’s National Treasury.