Kenyan borrowers take out KES 500 million daily, amounting to KES 15 billion monthly, according to a new report by the Digital Financial Services Association of Kenya (DFSAK).

The report reveals that over 8 million Kenyans—about 16% of the population—actively borrow each month, benefiting from digital lenders.

The industry has been instrumental in financing the boda boda sector, with nearly all riders relying on non-deposit-taking credit providers.

“The digital lending industry has become crucial for growth—attracting foreign investment, creating jobs, taking risks, and lifting millions out of poverty,” said Kevin Mutiso, DFSAK Chairman. “We remain committed to empowering and protecting this vital sector for the benefit of all Kenyans.”

The report highlights how digital lenders are boosting financial inclusion, financing an average of 100,000 smartphones monthly, significantly increasing internet access and digital participation.

DFSAK welcomed the Business Laws (Amendment) Act 2024, which took effect in January, placing digital credit providers under Central Bank of Kenya regulation. This has brought much-needed clarity to the industry while strengthening consumer protection.

The association has already slashed consumer complaints from 4,000 a month to just a handful through the adoption of a stricter code of conduct. It is also working closely with the Office of the Data Protection Commissioner to establish further safeguards.

DFSAK is now focusing on tax reforms, particularly around bad debt allowances, to enhance industry sustainability. DFSAK has announced the addition of 4-G Capital and M-Kopa to its board, expanding its membership to seven.

Other board representatives include Aspira, Kuwazo, Oye Platform Solutions, Tala, and Zenka.

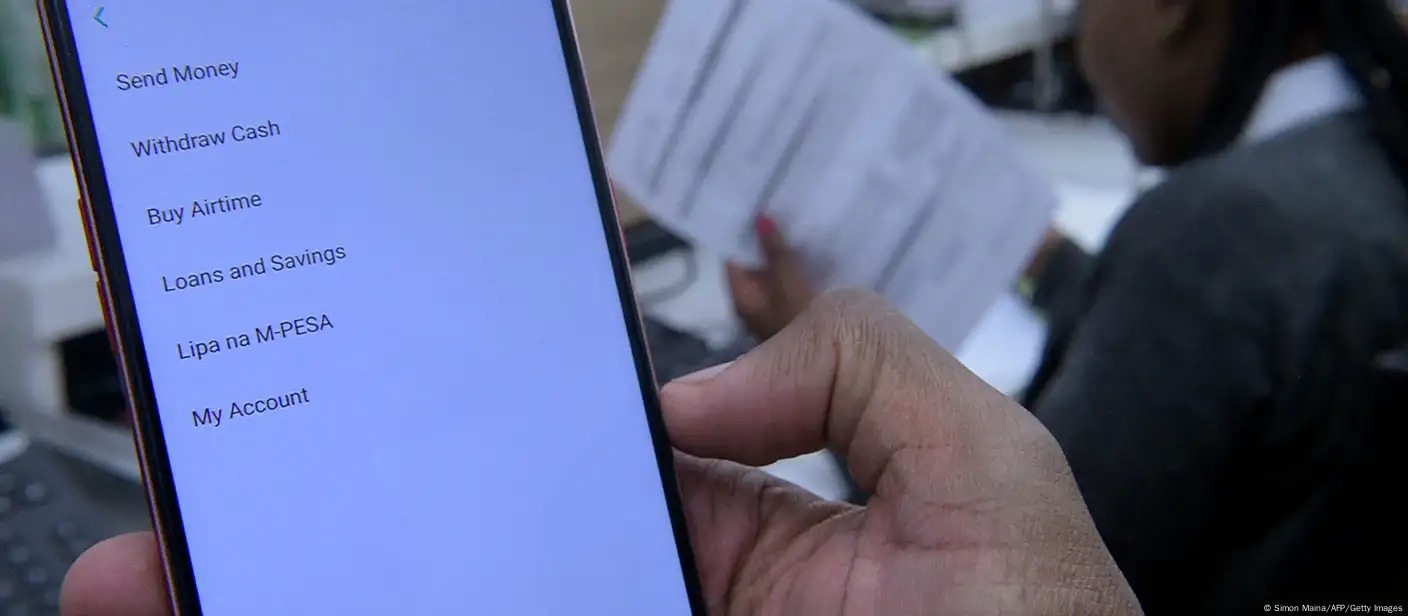

Kenya remains at the forefront of Africa’s digital lending revolution, driven by high mobile penetration and a growing demand for accessible financial solutions.

Responding to the International Monetary Fund’s recent comments on Kenya’s economic challenges, Mutiso reiterated that the digital lending industry will continue fueling economic growth, attracting investment, and supporting millions of Kenyans on their financial journeys.